marin county property tax rate

The median property tax on a 86800000 house is 546840 in Marin County. Secured property taxes are payable in two 2 installments which are due November 1 and February 1.

Marin County Real Estate Market Report January 2022 Latest News

Box 4220 San Rafael CA 94913.

. Not County of Marin. Property Tax and Tax Collector. Total tax rate Property tax.

Single Family Residential - Improved. The first installment is due November 1 2009 and is delinquent after December 10. This is the total of state and county sales tax rates.

If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711. 1 day agoAbout 10 of the 5250 residential properties in the affected West Marin communities are registered with the county as short-term rentals. The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public.

Tax Rate Book 2016-2017. What is the sales tax rate in Marin County. Marin County tax office and their website have the rules procedures.

Tax Rate Book 2015-2016. Tax Rate Book 2013-2014. Tax Rate Book 2012-2013.

Marin County Property Tax Tax Collector. In Stinson Beach and Marshall about 20. Overview of Marin County CA Property Taxes.

The Marin County Assessor Supplemental Tax Estimator provides an estimate of the amount of supplemental taxes a taxpayer may anticipate. Marin County Tax Collector PO. 825 Is this data incorrect The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe local sales.

If you have questions about the following information. The Assessment Appeals Board. California has a 6 sales tax and Marin County collects an additional 025 so the minimum sales tax rate in Marin County is 625 not including any city or special district taxes.

Tax Rate Book 2014-2015. Payment of property taxes should be remitted to the Marin County Tax Collector Civic Center San Rafael. If using your banks online.

The median property tax also known as real estate tax in Marin County is 550000 per year based on a median home value of 86800000 and a median effective property tax rate of. The supplemental tax bill is in addition to the. In the midst of the recession in 1991-92 the State Legislature exercised this power to take city.

In Stinson Beach and. Offered by County of Marin California. If you are planning to buy a home in Marin County and want to understand the size of your property tax bill and.

Most of the growth in Marin was from a 415 increase in property valuations. Marin County Property Search. Single Family Residential - Improved.

If you have questions about the following information. This years tax roll of 1262606363 is up. The minimum combined 2022 sales tax rate for Marin County California is.

How was your experience with papergov. Marin County is responsible for assessing the tax value of your property and that is where you will register your appeal. General obligation bonds accounted for 245 and new parcel taxes accounted for 04.

The median property tax on a. The Tax Division includes the Property Tax and Tax Collector sectors within the Department of Finance. Penalties apply if the installments are not paid by December 10 or April 10 respectively.

16 hours agoAbout 10 of the 5250 residential properties in the affected West Marin communities are registered with the county as short-term rentals. San Rafael CA Marin Countys 2021-22 property tax bills 91854 of them were mailed to property owners September 24. This collection of links contains useful information about taxes and assessments and services available in the County of Marin.

The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. The median property tax on a 86800000 house is 642320 in California. Please retain the payment confirmation number provided at the end of the transaction for your records.

Transfer Tax In Marin County California Who Pays What

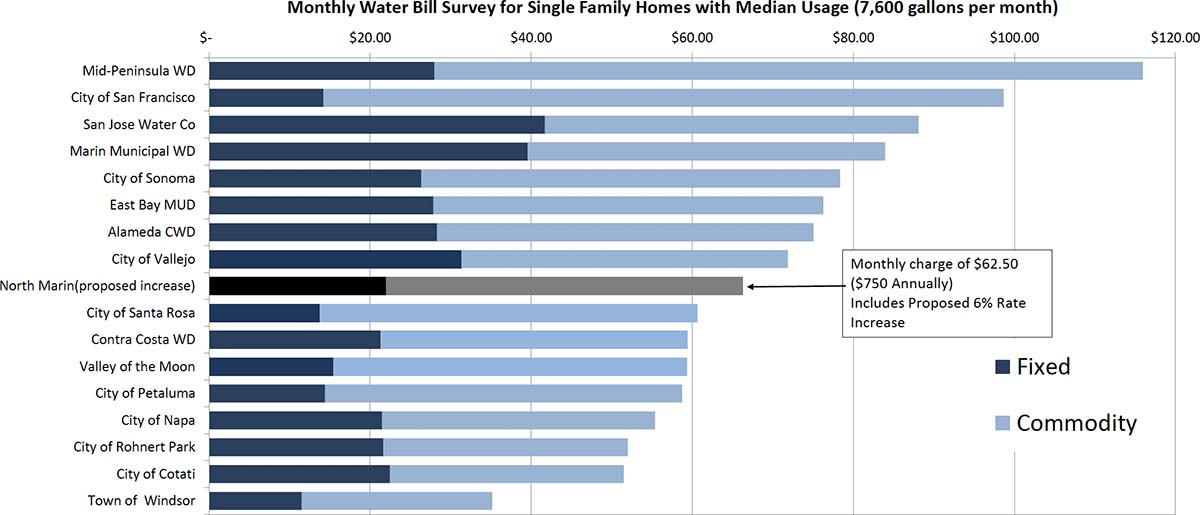

Rates North Marin Water District

Pin On Articles On Politics Religion

Marin County Real Estate Market Report January 2022 Latest News

Mortgage Rates Fall 15 Year Fixed At Record 30 Year Mortgage Mortgage Rates Refinance Mortgage

Marin Wildfire Prevention Authority Measure C Myparceltax

Marin County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Marin County Real Estate Market Report April 2022 Latest News

Marin Wildfire Prevention Authority Measure C Myparceltax

Transfer Tax In Marin County California Who Pays What

Marin County Real Estate Market Report June 2021 Latest News

Marin County Real Estate Market Report April 2022 Latest News

Marin Pilot Program Aims To Entice Landlords To Accept Section 8 Being A Landlord Entice Pilot

Marin County California Property Taxes 2022

Covid 19 Case Rates Drop In Senior Facilities Post Vaccine

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

Real Estate Is My Business Real Estate Buyers Real Estate Infographic Real Estate Trends