monterey county property tax due dates

178th out of 3143. First installment of secured property taxes is due and payable.

Property taxes are due january 1st for the previous year.

. Choose Option 3 to pay taxes. Tax bills are generated every fiscal year. Property taxes levied for the property tax year are payable in two installments.

The second installment is due March 1. The second payment is due september 1 2021. Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomontereycaus Property Tax Due Date Reminder.

1-831-755-5057 - Monterey County Tax Collectors main telephone number. Payments may be made in person at. Heres how Monterey Countys property tax compares to the 3142 other counties nationwide.

The first installment is due September 1 of the property tax year. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. January 1 - Lien date the date taxable value is established and property taxes become a lien on the property.

To calculate your property tax in Monterey county you take the. July 1 - Beginning of the Countys fiscal year. Property taxes are due january 1st for the previous year.

Monterey County Treasurer - Tax Collectors Office. If the Form 11 is mailed after April 30 of the assessment. 630 pm pdt apr 8 2020.

Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomontereycaus. Sewage treatment plants and athletic parks with. Payments may be made in person at.

The second payment is due September 1 2021. Secured property taxes are levied on property as it exists on January 1st at 1201 am. Monterey determines tax levies all within the states constitutional guidelines.

You can call the Monterey County Tax Assessors Office for assistance at. Property taxes are levied on property as it exists on January 1st at 1201 am. The state relies on real estate tax revenues a lot.

Look up the Monterey County property tax. Last date to mail the Notice of Assessment Form 11 for the appeal deadline of June 15 of the assessment year. The second payment is due september 1 2021.

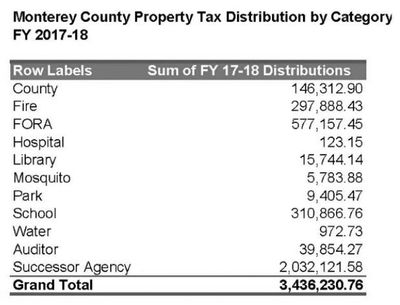

Tax bills are generated every fiscal. Not only for Monterey County and cities but down to special-purpose districts as well eg. Monterey County Property Tax Due Dates.

Any property owner with questions about their property tax bill should contact the Tax Collectors Office at 831-755-5057 or taxcollectorcomontereycaus. By median yearly property tax. Appeals of supplemental and escaped assessments must be filed within 60 days of the mailing date on.

August 1- Unsecured bills due. When contacting Monterey County about your property taxes make sure that you are contacting the correct office. As well explain further appraising real estate billing and collecting payments conducting compliance tasks.

You will need your 12-digit ASMT number found on your tax bill to make payments. Transient Occupancy Tax TOT delinquency deadline if not paid before 500 pm.

Property Tax Due Date Reminder Monterey County Mdash Nextdoor Nextdoor

Monterey County Ca Land For Sale 282 Listings Landwatch

Monterey County Officials Cut Cannabis Taxes Again Monterey Herald

Monterey County Ca Property Data Real Estate Comps Statistics Reports

A Guide To Closing Costs Blog Jennifer Ferland

Treasurer Tax Collector Monterey County Ca

Pay Property Taxes Online County Of Ventura Papergov

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Monterey County Assessor Office 12 Photos 168 W Alisal St Salinas Ca Yelp

Monterey County Property Tax Guide Assessor Collector Records Search More

Monterey County Supplemental Disclosure Fill Out Sign Online Dochub

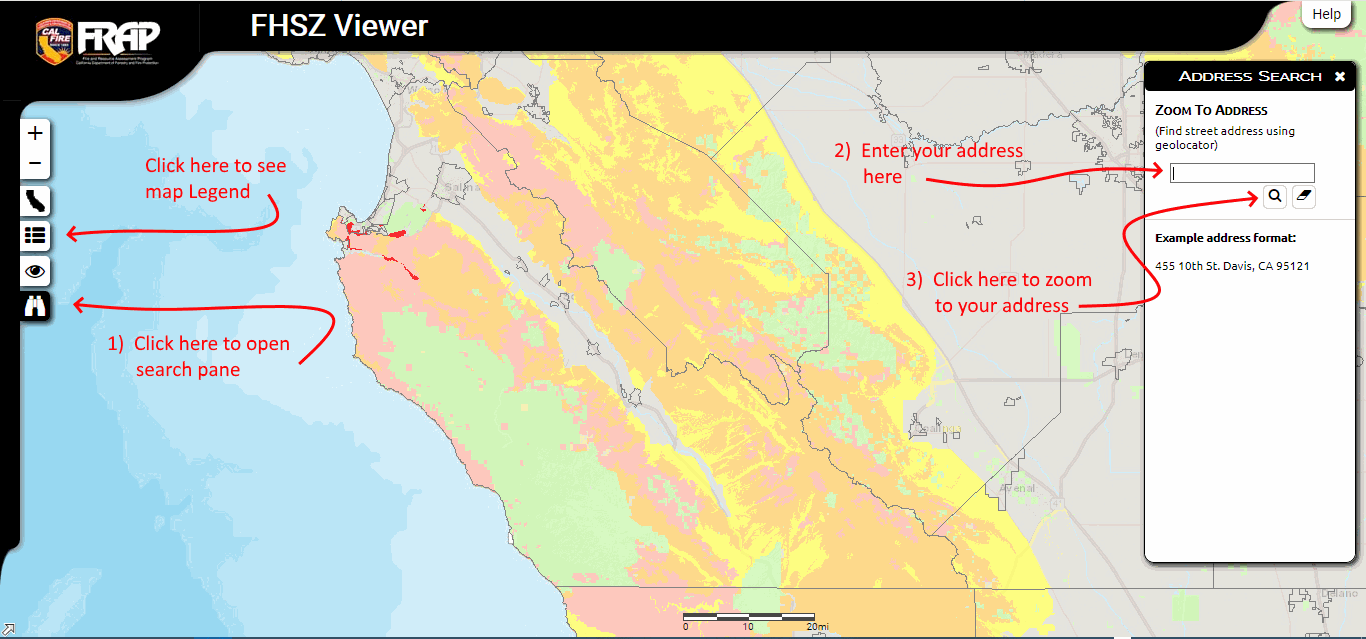

Wildfire Safety Fire Safe Council For Monterey County

Brown County Property Taxation

Ten Steps To Divorce In Monterey Monterey Divorce Attorneys

Cities Ask Monterey County For 2 Million In Overcharged Property Tax Fees News Montereycountyweekly Com